Reported by The Common Wealth Fund, President-elect Donald Trump and Republican leaders of Congress seek to repeal and replace the Affordable Care Act (ACA)—also known as Obamacare—in 2017. A likely strategy is to repeal two key elements of the health reform law: the insurance premium tax credits and the expansion of Medicaid eligibility. A bill passed by Congress in 2015 (H.R. 3762) sought to do just that beginning in 2018—with no replacement plan—but it was vetoed by President Obama. The new Congress could pass a repeal bill in early 2017 but not develop a replacement bill until later.

Recent analyses show canceling the ACA’s tax credits and Medicaid expansion would double the number of uninsured Americans. As millions lose their insurance, hospitals and other providers would see their uncompensated medical care costs soar by $1.1 trillion from 2019 to 2028, and they would experience major revenue losses as well.

But repeal could also have much broader economic repercussions. Our analysis examines the potential economic and employment effects of repealing the ACA’s tax credits and Medicaid expansion, without a replacement plan, for every state and the District of Columbia. We estimate changes in:

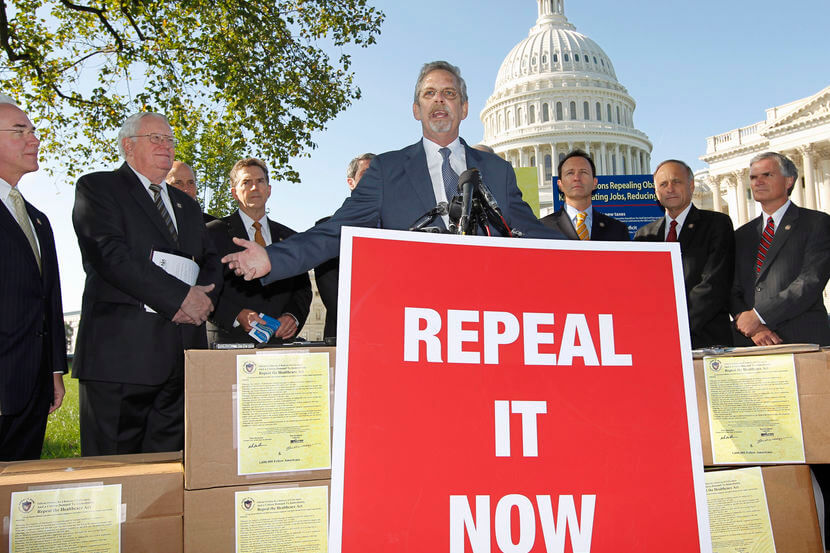

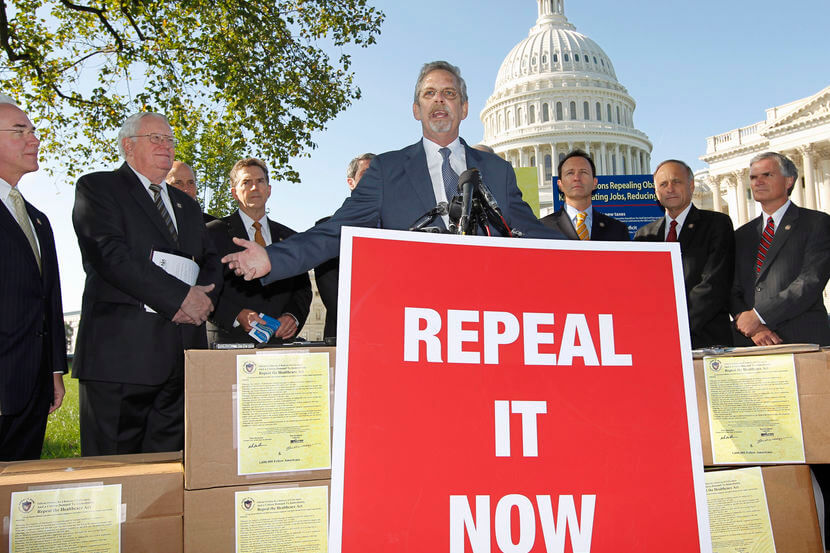

Although the ACA dramatically lowered the number of uninsured, Republican leaders believe that the law is harmful and are committed to its repeal. A plausible scenario is that, in 2017, Congress passes a budget resolution requiring the repeal of key ACA provisions. This would be accomplished through a reconciliation bill that could be passed by simple majorities in the House of Representatives and the Senate—the strategy used to pass H.R. 3762 in 2015. Numerous Republican replacement policies have been suggested, though a consensus has yet to emerge.7 Thus, Congress may pass repeal in early 2017, with implementation delayed for a couple of years, but replacement policies are likely to be developed much later.

Because plans for replacement are unresolved, we focus on the repeal of federal premium tax credits and Medicaid expansion. Key elements of the current policies are:

Health care will comprise almost one-fifth (18.5%) of the nation’s economy by 2019. As such, major changes to health care will reverberate across other parts of the economy.

These economic consequences can be projected by analyzing how funding flows from the federal government to states, consumers, and businesses. As illustrated in Exhibit 1, federal tax credits first flow to health insurers. Most of the money, aside from carriers’ overhead, flows to hospitals, clinics, pharmacies, and other providers. Similarly, federal funding supports state Medicaid programs, which pay health care providers. These are the direct effects of federal funding.

Click the link below to view the full report:

The Common Wealth Fund – Repealing Federal Health Reform